The City of Swift Current Taxation Department has mailed out 2023 Property Tax notices for delivery to Swift Current property owners.

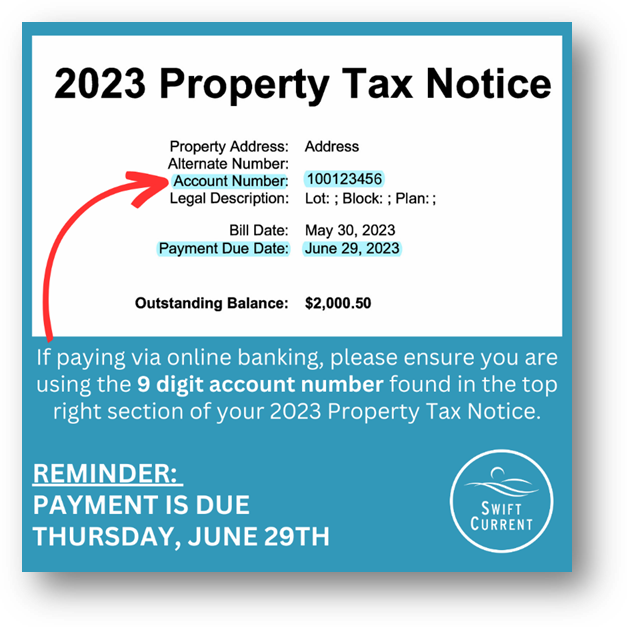

The Taxation Department would like to draw the public’s attention to the due date this year, as it’s affected by the Statutory Holiday observance on June 30, 2023. Therefore, the due date for payment of 2023 property taxes is June 29, 2023.

In addition, Taxation requests that citizens who use online banking please double check their account numbers before paying their bill online. “Our software assigns a 9 – digit account number to your property, and it starts with the number 1 as the first digit,” explains Kari Cobler, General Manager of Corporate Services. “Some customers haven’t updated their account numbers with their banks, using accounts generated by our old software with alpha-numeric combinations which are no longer valid. This causes their financial institution to reject their payment. To make the payment process as smooth as possible for property owners, we’re emphasizing the importance of using our 9-digit account numbers to ensure people can pay online without any obstacles.”

Ms. Cobler continues, “Online banking is only one of a few options for payment of property taxes. The 9-digit account numbers do not affect those who have set up Pre-Authorized Payments that come out automatically. Payment can also be remitted through Swift Connect, the City’s online portal, as well as paying by mail, or by visiting us at City Hall where we can serve you in-person and answer any questions you may have. Remember that we’re closed on June 30th, so the due date is June 29th this year.”

How is property tax calculated?

Each year, recurring factors affect property taxes which are based on a property’s assessed value – municipal uniform rate and mill rate factors, and education mill rates.

The City is responsible for setting the municipal uniform mill rate and mill rate factors. The approved municipal budget for 2023 reflected a 3.99% tax increase; therefore, municipal taxes distinctly set out on each property tax notice will reflect an increase.

Education Mill rates are set and controlled by the Province of Saskatchewan for public school support and Holy Trinity School Division for separate school support. The City is responsible to levy and collect the education tax but has no authority to set the mill rate.

Property owners are encouraged to read their Property Taxes carefully upon receipt.

The City of Swift Current Taxation Department can be reached via email at taxation@swiftcurrent.ca or call Ryan Lochart, Manager of Revenue & Collections at (306)-778-2704, or Wanda Masse, Tax Roll Clerk at (306)-778-2703.